In the past the International Monetary Fund was consistently criticised by some for always imposing impoverishing austerity on the economies it supported for the sake of preserving the interests of foreign (mostly developed world) investors. More recently, under Christine Lagarde, it has sometimes called for a moderation of austerity to avoid driving 'rescued' or recovering economies deeper into recession. There was a famous little muted spat between the IMF and the UK Chancellor George Osborne on this subject. However, with the improving economic data from the UK, Osborne has been able to announce that his government has 'fixed the economy' - his phrase.Well, it's obvious, isn't it? The Labour government 'wrecked' the economies; the Conservative/Liberal Democrat coalition (but you can forget the secondary partners now) 'fixed' it. These things don't happen unless the people in control will them.

But now, as the federal reserve in the US, flirts nervously with the famous and long looming 'tapering' to withdraw the massive financial stimulus to the economy, rippling signs of dependency and withdrawal symptoms begin to appear. Christine Lagarde is on the case and has warned the World Economic Forum at Davos.

'This is clearly a new risk on the horizon and it needs to be closely watched ... How tapering takes place, at what speed, how it is communicated and what spillover effects it has, particularly in emerging markets.'

Larry Fink, chairman of fund manager BlackRock, saw it rather differently. He told the WEF that one of his concerns was the large positions held by investors in various emerging markets. However, he claimed that tapering was not the main problem. 'It's going to require much better domestic policy in these emerging markets.'

In other words the IMF needs to get a grip = like it used to have.

Showing posts with label economics. Show all posts

Showing posts with label economics. Show all posts

Sunday, 26 January 2014

Saturday, 23 November 2013

People power

When a senior manager at Ford was showing off an automated production line to Walter Reuther, leader of the United Automobile Workers union, in the early 1950s, he asked: "Walter, how will you get these machines to pay their union dues?" To which Reuther replied: "How will you get them to buy your cars?"

From article here.

Saturday, 9 November 2013

Cluster think in the USA

Janet Yellen on employment.

And a jest that currently circulates on the web:

Our Fed

Who art in Washington

Yellen be thy name

Thy printing come

Thy will be done by Ben as it is with Janet

Give us this day our daily 3 billion

And increase us our debts

As we bail out our debtors

And lead us not into inflation

But deliver us from down markets

For thine is the printing, the bubble and the euphoria

Forever till taper

Amen

Thursday, 23 May 2013

Monday, 22 April 2013

Robust

It would appear that it takes three years for a basic spread sheet error to be discovered that undermines the fundamental conclusion of an economics paper that has been highly influential in shaping the austerity policies of western governments.

The interval is necessary to enable belief in the argument to solidify to the point where it is independent of evidence so that, in the words of our Chancellor, it "remains robust".

The interval is necessary to enable belief in the argument to solidify to the point where it is independent of evidence so that, in the words of our Chancellor, it "remains robust".

Friday, 19 April 2013

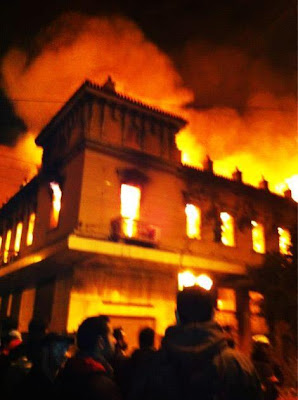

Burn, baby, burn

Lord Stern estimated that it would require 1 per cent of GDP to move to clean and sustainable energy sources.

In 2012 the top 200 corporation spent a sum equivalent to 1 per cent of global GDP to find new sources of carbon energy. Carbon assets are currently valued at trillions of dollars but about two thirds of them will have to remain permanently unburnt to comply with current (though unformalised) international agreements on climate change.

'They only believe environmental regulation when they see it," said James Leaton, from Carbon Tracker and a former PwC consultant. He said short-termism in financial markets was the other major reason for the carbon bubble. "Analysts say you should ride the train until just before it goes off the cliff. Each thinks they are smart enough to get off in time, but not everyone can get out of the door at the same time. That is why you get bubbles and crashes."

'Paul Spedding, an oil and gas analyst at HSBC, said: "The scale of 'listed' unburnable carbon revealed in this report is astonishing. This report makes it clear that 'business as usual' is not a viable option for the fossil fuel industry in the long term. [The market] is assuming it will get early warning, but my worry is that things often happen suddenly in the oil and gas sector."'

'Stern and Leaton both point to China as evidence that carbon cuts are likely to be delivered. China's leaders have said its coal use will peak in the next five years, said Leaton, but this has not been priced in. "I don't know why the market does not believe China," he said. "When it says it is going to do something, it usually does." He said the US and Australia were banking on selling coal to China but that this "doesn't add up"'

'Jeremy Grantham, a billionaire fund manager who oversees $106bn of assets, said his company was on the verge of pulling out of all coal and unconventional fossil fuels, such as oil from tar sands. "The probability of them running into trouble is too high for me to take that risk as an investor." He said: "If we mean to burn all the coal and any appreciable percentage of the tar sands, or other unconventional oil and gas then we're cooked. [There are] terrible consequences that we will lay at the door of our grandchildren."'

http://www.guardian.co.uk/environment/2013/apr/19/carbon-bubble-financial-crash-crisis

'"Now, with strong interconnections, and uneven recovery, that three-speed recovery is not enough and what we need is a full-speed global economy." Lagarde said growth needed to be "solid, sustainable, balanced but also inclusive and very much rooted in green developments."

'The IMF managing director said central banks were travelling in "uncharted territories" and would be more comfortable if they could return monetary policy to more normal settings.'

In 2012 the top 200 corporation spent a sum equivalent to 1 per cent of global GDP to find new sources of carbon energy. Carbon assets are currently valued at trillions of dollars but about two thirds of them will have to remain permanently unburnt to comply with current (though unformalised) international agreements on climate change.

'They only believe environmental regulation when they see it," said James Leaton, from Carbon Tracker and a former PwC consultant. He said short-termism in financial markets was the other major reason for the carbon bubble. "Analysts say you should ride the train until just before it goes off the cliff. Each thinks they are smart enough to get off in time, but not everyone can get out of the door at the same time. That is why you get bubbles and crashes."

'Paul Spedding, an oil and gas analyst at HSBC, said: "The scale of 'listed' unburnable carbon revealed in this report is astonishing. This report makes it clear that 'business as usual' is not a viable option for the fossil fuel industry in the long term. [The market] is assuming it will get early warning, but my worry is that things often happen suddenly in the oil and gas sector."'

'Stern and Leaton both point to China as evidence that carbon cuts are likely to be delivered. China's leaders have said its coal use will peak in the next five years, said Leaton, but this has not been priced in. "I don't know why the market does not believe China," he said. "When it says it is going to do something, it usually does." He said the US and Australia were banking on selling coal to China but that this "doesn't add up"'

'Jeremy Grantham, a billionaire fund manager who oversees $106bn of assets, said his company was on the verge of pulling out of all coal and unconventional fossil fuels, such as oil from tar sands. "The probability of them running into trouble is too high for me to take that risk as an investor." He said: "If we mean to burn all the coal and any appreciable percentage of the tar sands, or other unconventional oil and gas then we're cooked. [There are] terrible consequences that we will lay at the door of our grandchildren."'

http://www.guardian.co.uk/environment/2013/apr/19/carbon-bubble-financial-crash-crisis

'"Now, with strong interconnections, and uneven recovery, that three-speed recovery is not enough and what we need is a full-speed global economy." Lagarde said growth needed to be "solid, sustainable, balanced but also inclusive and very much rooted in green developments."

'The IMF managing director said central banks were travelling in "uncharted territories" and would be more comfortable if they could return monetary policy to more normal settings.'

Saturday, 13 April 2013

Versions of history

Some who oppose every aspect of Mrs Thatcher's political legacy have said that, nonetheless, her passing causes them to lament that she was the last British political leader who said what she meant and had any sense of history.

However there are alternative historical narratives into which she might be seen to fit. Such ideas may seem improbably far-fetched and much too close to the delusions of conspiracy theory - except when one looks around at the sheer scale of the egregiousness of the economic and politcal status quo today one has to wonder.

One has to ask why, if the titans of the US banking world were surreptitiously implementing a political programme of not just American dominance at the expense of other nations but of permanently enriching the financial elite of their own country at the expense of the population at large, any one of them would publish even a short and little known book outlining his intentions; or how, in a wider context, apparently conflicting motives can be united in a single, cunning plan. Yet one then reflects how much of those intentions has actually come about, that even if the wheels are not oiled as efficiently as some observers suppose the charriot may nevertheless be headed in that direction, and that the few countries that have stood outside the dollar-dominated system of the issuance of money as debt number Libya, Iran and North Korea.

It's probably best to get back in the garden - or the workshop - or talk to the cat.

However there are alternative historical narratives into which she might be seen to fit. Such ideas may seem improbably far-fetched and much too close to the delusions of conspiracy theory - except when one looks around at the sheer scale of the egregiousness of the economic and politcal status quo today one has to wonder.

One has to ask why, if the titans of the US banking world were surreptitiously implementing a political programme of not just American dominance at the expense of other nations but of permanently enriching the financial elite of their own country at the expense of the population at large, any one of them would publish even a short and little known book outlining his intentions; or how, in a wider context, apparently conflicting motives can be united in a single, cunning plan. Yet one then reflects how much of those intentions has actually come about, that even if the wheels are not oiled as efficiently as some observers suppose the charriot may nevertheless be headed in that direction, and that the few countries that have stood outside the dollar-dominated system of the issuance of money as debt number Libya, Iran and North Korea.

It's probably best to get back in the garden - or the workshop - or talk to the cat.

Tuesday, 9 April 2013

Saturday, 17 November 2012

East and West: the twain meet

The conventional wisdom seems to be that China needs to keep its economy growing at more than 7 per cent a year to prevent the resentments and frustrations of its population from boiling over into civil unrest against corruption and autocracy - and to drag along the rest of a recession-hit world (forget about global imbalances just as long as there's money somewhere).

China has problems, we all agree.

It is less often said which part of the Chinese population is likely to bring down the house of cards. Will it be the hard pressed FoxConn worker or the frustrated wheeler-dealer with the illegal helicopters hidden in his warehouse? Because China has telescoped a few centuries of western European social and economic development into a few decades (leaving out the political bit) it is difficult to tell. Which is tragedy and which is farce? In this country the middle class commercial interests got their legitimate place in the scheme of government long before industrialisation and urbanisation transformed the make-up of society and so some sections of it could work for the great social reforms of the nineteenth century that stabilised society as the economy expanded and urbanised dramatically. Not so in China, whose breakneck speed of expansion the west is ever keen to stoke up with incendary industrial and financial devices, whilst below offering a low murmur of distress at the destruction of historic culture and at the impending environmental collapse.

Meanwhile, in the west, as economic growth sinks in more and more countries into negative figures, the question is again how can popular civil unrest and violence be avoided. We have democracy (which at times we tell ourselves it is patronising to assume the Chinese people want - they just want to be able to keep on making mobile phones for us, don't they, like we just want to be able to keep on buying them?), but increasingly, as governments fail to respond to popular discontents and as they accept the impositions of unelected international bodies, democracy is perceived as a sham and an excuse for the accelerating transfer of wealth from the poor to the rich.

So where lies the path to the sunlit uplands for us? A leading official of the Chinese sovereign wealth fund knows. Ironic? Perhaps not: the Chinese sovereign wealth fund needs markets like almost no-one else. China, which has been buying in Greece, plans to bury the West in a different way to that which Mr Kruschev threatened: not in a pile of thermo-nuclear rubble, but in a growing mountain of largely plastic consumer goods, durable only in their powdered detritus in the world's oceans. According to Mr Jin, Europe needs to moderate the pace of austerity - if that is not too bizarre a concept. Austerity must continue; it just needs to be a little less severe, and to go on for longer. For ever, preferably, getting rid of those fibre-sapping and unaffordable social welfare and employment protection provisions. In other words, Europe needs to be more like China. We need 'to work a little harder and work a little longer'. Nothing too frightening, you understand. A touch on the tiller here, a touch on the tiller there. We're all, east and west, in this together: we can go on for ever. The Great Helmsman returns! But is it Mao or Ted Heath?

Meanwhile Foxconn, which, although all one tends to hear about are its vast factories in mainland China, is of course based in Taiwan, that elder child of the marriage of East and West, actually knows what the weather is like in the streets. It is finding that Chinese labour costs are growing too high for servicing the declining real-terms disposable incomes of the West (I expect someone has told Mr Jin) and is busily buying up vast tracts of land in Brazil and planning to open factories in the USA - in places like Detroit. Perhaps the Chinese sovereign wealth fund can invest in them. Yet of course American labour costs are also too high to service the diminishing purchasing power of American consumers - a problem for which Foxconn's answer is said to be making the factories purely automated. Is there still a problem there? Where is the money?

China has problems, we all agree.

|

| East |

|

| West |

Meanwhile Foxconn, which, although all one tends to hear about are its vast factories in mainland China, is of course based in Taiwan, that elder child of the marriage of East and West, actually knows what the weather is like in the streets. It is finding that Chinese labour costs are growing too high for servicing the declining real-terms disposable incomes of the West (I expect someone has told Mr Jin) and is busily buying up vast tracts of land in Brazil and planning to open factories in the USA - in places like Detroit. Perhaps the Chinese sovereign wealth fund can invest in them. Yet of course American labour costs are also too high to service the diminishing purchasing power of American consumers - a problem for which Foxconn's answer is said to be making the factories purely automated. Is there still a problem there? Where is the money?

|

| Welcome to Detroit |

Saturday, 20 October 2012

Where next for the banking 'crisis'?

China's shadow banking sector has become a potential source of systemic financial risk over the next few years. Particularly worrisome is the quality and transparency of WMPs. Many assets underlying the products are dependent on some empty real estate property or long-term infrastructure, and are sometimes even linked to high-risk projects, which may find it impossible to generate sufficient cash flow to meet repayment obligations.

Moreover, many WMPs are not even linked to any specific asset, rather, just to a pool of assets, whose cash inflows may often not match the timing of scheduled WMP repayments.

China's shadow banking is contributing to a growing liquidity risk in the financial markets. Most WMPs carry tenures of less than a year, with many being as short as weeks or even days. Thus in some cases short-term financing has been invested in long-term projects, and in such situations there is a possibility of a liquidity crisis being triggered if the markets were to be abruptly squeezed.

In fact, when faced with a liquidity problem, a simple way to avoid the problem could be through using new issuance of WMPs to repay maturing products. To some extent, this is fundamentally a Ponzi scheme. Under certain conditions, the music may stop when investors lose confidence and reduce their buying or withdraw from WMPs. The rollover of a large share of WMPs could weigh heavily on formal banks' reputations, because many investors firmly believe that banks won't close down and they can always get their money back.

The article quoted is written by Mr Gang and appeared in China Daily, a state controlled publication and the country's largest English language paper. The financial activity that concern Mr Gang would of course show up in the statistics as part of China's current economic growth.

I am indebted to Golem XIV for this reference and more comment on the article and the situation in China can be found on his blog.

Thursday, 11 October 2012

Existing cash resources 2

But don't give them the taxes.

The British arm paid its 90 UK-based staff an average of £275,000 each in 2011 while contributing just £195,890 to the Treasury's coffers, according to the firm's latest accounts filed at Companies House.

The website also reported UK revenues of £20.4m, a fraction of the £175m that media analysts estimate the firm made in the UK in 2011.

Furthermore, Facebook UK's latest figures show that the company charged £15.4m to its 2011 accounts – which can be used to reduce future tax bills – as a cost of awarding its UK staff share options. Murphy said: "That appears to be £15.4m to reward £20.4m in sales. That makes no sense. The options must, of course, be based on the value of sales recorded in Ireland but the UK is bearing the cost of the tax relief on paying these options.

http://www.guardian.co.uk/technology/2012/oct/10/facebook-uk-taxes

Monday, 8 October 2012

Wednesday, 12 September 2012

iRecovery

J P Morgan's chief economist, Michael Feroli in a note to clients has suggested that the anticipated launch of Apple's iPhone 5 could lead to sales that could increase US economic growth by between 0.25 and 0.5 percent. "Calculated using the so-called 'retail control method', sales of iPhone 5 could boost annualized GDP growth by $3.2bn, or $12.8bn at an annual rate", thus offsetting "the downside risk to our Q4 GDP growth projection, which remains 2%".

The comment of another US economic analyst was "God help us."

The iPhone 5 is expected to retail at about $600.

Manufacturing costs are thought to be about $200,

Maybe it will save the Chinese economy as well.

The comment of another US economic analyst was "God help us."

The iPhone 5 is expected to retail at about $600.

Manufacturing costs are thought to be about $200,

Maybe it will save the Chinese economy as well.

|

| iPhone prelapse: the beginnings of growth |

Monday, 14 May 2012

Apart from that, Mr Dimon ...

"We made a terrible, egregious mistake," Dimon said in an interview on NBC's Meet the Press on Sunday. "There's almost no excuse for it."

He said bank executives were completely wrong in public statements made in April after being challenged over the trades in media reports.

"We got very defensive. And people started justifying everything we did. We told you something that was completely wrong a mere four weeks ago."

Dimon added: "In hindsight we took far too much risk, the strategy was barely vetted, it was barely monitored. It should never have happened."

... how is the teapot?

He said bank executives were completely wrong in public statements made in April after being challenged over the trades in media reports.

"We got very defensive. And people started justifying everything we did. We told you something that was completely wrong a mere four weeks ago."

Dimon added: "In hindsight we took far too much risk, the strategy was barely vetted, it was barely monitored. It should never have happened."

... how is the teapot?

Tuesday, 8 May 2012

Maybe now

"In 2007, the final year before the meltdown, shareholders received £2.23bn and BarCap's 16,200 investment bankers took home £1.3bn in bonuses. By 2009, bonuses had reached £2.2bn but shareholders received just £285m".

But let's not get too excited about the 'shareholder spring' with some of them waking from their long slumber. Shareholder Value Maximisation with its inevitable pressure towards short-term priorities can drive companies and wider concepts of social wealth into the wall as much as executive looting.

But let's not get too excited about the 'shareholder spring' with some of them waking from their long slumber. Shareholder Value Maximisation with its inevitable pressure towards short-term priorities can drive companies and wider concepts of social wealth into the wall as much as executive looting.

Monday, 7 May 2012

Let's shift again, like we did last summer

"Financial markets reeling after France and Greece elections"

"The French outcome was as expected. The markets have already shifted to a view that austerity on its own wasn't the right policy mix and that other things needed to be considered."

Richard Yetsenga, Head of Global Markets at ANZ Research.

"Austerity will not work to solve Europe's debt crisis. However, shifting austerity to higher earners and business will accelerate the debt crisis."

Jeff Sica, president of SICA Wealth Management

Shifting market wisdom: it's fortunate someone has such foresight and vision. No wonder the voters are so calm.

"The French outcome was as expected. The markets have already shifted to a view that austerity on its own wasn't the right policy mix and that other things needed to be considered."

Richard Yetsenga, Head of Global Markets at ANZ Research.

"Austerity will not work to solve Europe's debt crisis. However, shifting austerity to higher earners and business will accelerate the debt crisis."

Jeff Sica, president of SICA Wealth Management

Shifting market wisdom: it's fortunate someone has such foresight and vision. No wonder the voters are so calm.

Saturday, 5 May 2012

Who's sorry now?

Philip Hammond, the government's defence secretary (defence of what, one wonders) has some stern words for 'ordinary people':

"People say to me, 'It was the banks'. I say, 'hang on, the banks had to lend to someone'. People feel in a sense that someone else is responsible for the decisions they made. Of course, if banks don't offer credit, people can't take it. [But] there were two consenting adults in all these transactions, a borrower and a lender, and they may both have made wrong calls. Some people are unwilling to accept responsibility for the consequences of their own choices."

So it's all our fault. It sounds rather cosy actually. The idea that the world economy got into a bit of a pickle because we all pulled a bit of a fast one on our bank managers and borrowed too much for new cars and garden patios. Into the headmaster's study for a bit of a wigging and we can pull our socks up in no time and sort it all out.

For a slightly different suggestion of the scale and location of the problem that 'the banks had to lend to someone' (and how) look at these graphics:

http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html?source=patrick.net

and for and view of what the future may hold on our high-finance roller-coaster see:

http://www.golemxiv.co.uk/2012/05/etfs-part-2/.

Meanwhile, who's got the real money?

http://www.ey.com/UK/en/Issues/Business-environment/Financial-markets-and-economy/ITEM---Background.

And so

http://www.youtube.com/watch?v=TjHJ_snG3RI

"People say to me, 'It was the banks'. I say, 'hang on, the banks had to lend to someone'. People feel in a sense that someone else is responsible for the decisions they made. Of course, if banks don't offer credit, people can't take it. [But] there were two consenting adults in all these transactions, a borrower and a lender, and they may both have made wrong calls. Some people are unwilling to accept responsibility for the consequences of their own choices."

So it's all our fault. It sounds rather cosy actually. The idea that the world economy got into a bit of a pickle because we all pulled a bit of a fast one on our bank managers and borrowed too much for new cars and garden patios. Into the headmaster's study for a bit of a wigging and we can pull our socks up in no time and sort it all out.

For a slightly different suggestion of the scale and location of the problem that 'the banks had to lend to someone' (and how) look at these graphics:

http://demonocracy.info/infographics/usa/derivatives/bank_exposure.html?source=patrick.net

and for and view of what the future may hold on our high-finance roller-coaster see:

http://www.golemxiv.co.uk/2012/05/etfs-part-2/.

Meanwhile, who's got the real money?

http://www.ey.com/UK/en/Issues/Business-environment/Financial-markets-and-economy/ITEM---Background.

And so

http://www.youtube.com/watch?v=TjHJ_snG3RI

Thursday, 1 March 2012

Saving the banks, or saving the state?

It has long been pointed out that the prime beneficiaries of the various 'bailouts', including the 'rescue packages' for countries such as Ireland and Greece, have been the teetering banks.

Yesterday the European Central Bank announced the completion of the second phase of its emergency lending programme for 'European' banks. About four months after it provided 489 billion euros of cheap loans it has stumped up a further 529 billion at 1 per cent interest that has been eagerly 'hoovered up' (in the BBC's editor's phrase) by about 800 European banks. (Did you know there were that number of needy banks? I suppose, in Margaret Thatcher's phrase, quoting someone or other, 'the poor are always with us'.) The large number suggests that this time, unlike last, the facilitiy has been made available to smaller banks. Does that mean that that the ECB is now sufficiently confident of it all turning out well that it can extend its largesse pretty well universally, or that the perilious interconnectness of the banking system is now such as to force a redefinition of 'too big to fail'?

Where is the money going? A considerable part of it is being spent on buying European government debt, which of course yields considerably more than 1 per cent.

Spanish banks' holdings of government debt rose by 23bn euros in January. They rose a similar amount in December.

That means they have bought an extra 46bn euros worth of government bonds in the two months since the new ECB loan programme started. That's nearly five times more than they bought in the first 11 months of 2011.

As Julian Callow, of Barclays Capital, has pointed out, that 46bn euros is also the equivalent of more than half of the money the Spanish government needs to borrow this year to cover its budget deficit and maturing debt. So with today's loans, Spain's banks could cover the lot. If they decide to do so.

Spain is just one example. As the man said, we're all in this together. The question inevitably arises, who are 'we'? There is no sign that the newly created funds have benefited what the Americans call 'main street'.

There are other worries too. The ECB calls its operation LTRO, Long-Term Refinancing Operation. Three years may be a long time in banking, or in a senior banker's career, but some are worried whether banks will be strong enough when they have to refinance these loans. Peter Sands, chief executive of Standard Chartered bank, which has made clear it has not used the ECB facility, has warned that we may be 'laying the seeds for the next crisis':

"Banks are still going to have to refinance their loans in three years time. It's not clear what the exit strategy is, nor is it possible to predict what the long-term consequences will be."

There is also quantitative easing. Governments currently are playing down expectations of more but massive programmes have been undertaken by western governments: $2.3 trillion in the US, £325 billion in the UK. For thoughts about the nature of this operation see http://viableopposition.blogspot.com/2012/02/charlie-bean-strikes-again-impact-of.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FtTbKB+%28Viable+Opposition%29

Yesterday the European Central Bank announced the completion of the second phase of its emergency lending programme for 'European' banks. About four months after it provided 489 billion euros of cheap loans it has stumped up a further 529 billion at 1 per cent interest that has been eagerly 'hoovered up' (in the BBC's editor's phrase) by about 800 European banks. (Did you know there were that number of needy banks? I suppose, in Margaret Thatcher's phrase, quoting someone or other, 'the poor are always with us'.) The large number suggests that this time, unlike last, the facilitiy has been made available to smaller banks. Does that mean that that the ECB is now sufficiently confident of it all turning out well that it can extend its largesse pretty well universally, or that the perilious interconnectness of the banking system is now such as to force a redefinition of 'too big to fail'?

Where is the money going? A considerable part of it is being spent on buying European government debt, which of course yields considerably more than 1 per cent.

Spanish banks' holdings of government debt rose by 23bn euros in January. They rose a similar amount in December.

That means they have bought an extra 46bn euros worth of government bonds in the two months since the new ECB loan programme started. That's nearly five times more than they bought in the first 11 months of 2011.

As Julian Callow, of Barclays Capital, has pointed out, that 46bn euros is also the equivalent of more than half of the money the Spanish government needs to borrow this year to cover its budget deficit and maturing debt. So with today's loans, Spain's banks could cover the lot. If they decide to do so.

Spain is just one example. As the man said, we're all in this together. The question inevitably arises, who are 'we'? There is no sign that the newly created funds have benefited what the Americans call 'main street'.

There are other worries too. The ECB calls its operation LTRO, Long-Term Refinancing Operation. Three years may be a long time in banking, or in a senior banker's career, but some are worried whether banks will be strong enough when they have to refinance these loans. Peter Sands, chief executive of Standard Chartered bank, which has made clear it has not used the ECB facility, has warned that we may be 'laying the seeds for the next crisis':

"Banks are still going to have to refinance their loans in three years time. It's not clear what the exit strategy is, nor is it possible to predict what the long-term consequences will be."

There is also quantitative easing. Governments currently are playing down expectations of more but massive programmes have been undertaken by western governments: $2.3 trillion in the US, £325 billion in the UK. For thoughts about the nature of this operation see http://viableopposition.blogspot.com/2012/02/charlie-bean-strikes-again-impact-of.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+blogspot%2FtTbKB+%28Viable+Opposition%29

Wednesday, 22 February 2012

The last bonus

We are repeatedly told that those who run banks and other great enterprises require to be paid enormously because their jobs are so tremendously demanding and those who can do them are so few. I suspect that there are actually quite a number of people who could do them, and the evidence suggests that both the CEOs and the star traders often fail to perform above chance and that they can commit egregious errors, even when warned of their possibility.

Yet to pay such individuals truly exceptional amounts of money helps create the impression, to the impressionable, that they are truly, almost Platonically, exceptional people. For the rest of us, to fall in with this view of the world and to give the idea that we are all to be placed into the positions for which we are pre-eminently fitted, there has been created the panoply of ever-expanding competitive formal qualifications. In education and training, as in the economy, ranking and rating supplant judgement. Such a system favours those who can operate it, either as candidates or providers (witness the recent fuss here about our now privatised secondary education examining boards training teachers how to get the best out of their systems), but, beneath it, privilege and favouritism persist.

This is the new 'world-class' status to which we must all aspire (or, in the case of many labourers in the vineyard, sink) lest we perish. The result, amongst the people generally, is to detroy the hope of good fortune (a necessary element of social content always), the belief in an accommodating society (it is no accident that it is in supposedly meritocratic societies that social mobility has declined), and the faith in the nation as a legitimate and effective expression of collective choice (as para-governmental international agencies and trans-national corporations increasingly dictate terms to states). Across Europe the extremist tendencies flex their muscles in dark and disreputable corners, and Molotov cocktails are a growth industry.

Yet to pay such individuals truly exceptional amounts of money helps create the impression, to the impressionable, that they are truly, almost Platonically, exceptional people. For the rest of us, to fall in with this view of the world and to give the idea that we are all to be placed into the positions for which we are pre-eminently fitted, there has been created the panoply of ever-expanding competitive formal qualifications. In education and training, as in the economy, ranking and rating supplant judgement. Such a system favours those who can operate it, either as candidates or providers (witness the recent fuss here about our now privatised secondary education examining boards training teachers how to get the best out of their systems), but, beneath it, privilege and favouritism persist.

This is the new 'world-class' status to which we must all aspire (or, in the case of many labourers in the vineyard, sink) lest we perish. The result, amongst the people generally, is to detroy the hope of good fortune (a necessary element of social content always), the belief in an accommodating society (it is no accident that it is in supposedly meritocratic societies that social mobility has declined), and the faith in the nation as a legitimate and effective expression of collective choice (as para-governmental international agencies and trans-national corporations increasingly dictate terms to states). Across Europe the extremist tendencies flex their muscles in dark and disreputable corners, and Molotov cocktails are a growth industry.

Friday, 17 February 2012

Deft phrases

Lehman's was not thought to be 'too big to fail'. It was, after all, not particularly big. Our undoing lay in its interconnectedness. Now Greece is clearly seen as something of a minnow, but the world's leaders have learnt about 'contagion' and have been busily erecting 'firewalls'. Is our phraseology still smarter than our thought?

The impression made by Greek fire on the west European Crusaders was such that the name was applied to any sort of incendiary weapon, including those used by Arabs, the Chinese, and the Mongols. These, however, were different mixtures and not the Byzantine formula, which was a closely guarded state secret whose composition has now been lost. As a result, to this day its ingredients remain a matter of much speculation and debate, with proposals including naphtha, quicklime, sulphur, and niter. Byzantine use of incendiary mixtures was also distinguished by their employment of pressurized siphons to project the liquid onto the enemy.

|

| Firewall needed |

Subscribe to:

Posts (Atom)